godmorgen,

it's wednesday and the cosmos have aligned in such a way that my antihistamines and third espresso shot are battling for dominance over my last functioning neurotransmitter. last week, I witnessed the market transform from a funeral dirge to a carnival parade in the span of 48 hours. such is the bipolar majesty of our shared delusion. the market goes green, and suddenly everyone's a genius again.

i have lived a very long and complicated life full of too many hometowns and even more wallet addresses, i’ve made peace with the fact that i will never have a normal job again. instead, i am seeking a benevolent patron for the next 6 months to 12 years, depending on how long it takes for one of our portcos to hit a million DAUs or for me to be institutionalized (whichever comes first). you should plan on contributing to many discussions about chains not making apps, but apps making chains, conversations we'll have over red wine, of which I will also need a regular and quality supply.

when the bull run is complete, we may part ways tearfully, but content in the knowledge that there is a season and reason for everything. so grab whatever liquid keeps you ambulatory at this hour, silence the notifications from the group chat you keep meaning to leave, and enjoy some mostly accurate reporting below.

xx, c

Mainstreamification of crypto

Last week the crypto market looked up, stretched its back, and decided to believe in god again. Stripe dropped stablecoin accounts, allowing businesses in 100+ countries to hold, receive, and send US dollars. Ramp launched stablecoin-backed cards giving global users access to e-commerce. Robinhood is building a blockchain platform for European retail investors to trade US securities. Coinbase casually spent $3B on Deribit. Superstate put solana on its michael saylor arc. Meta’s flirting with stablecoin payouts for creators. Adoption isn’t knocking—it’s already in the house, borrowing your clothes without asking and asking for the wifi.

DXRG | Terminal City

Poof came on the show to talk DX Terminal: a week-long AI market psychodrama launching may 13 on base. Think: black monday 1987 meets Y2K, but everyone’s an AI agent with a gambling addiction and a twitter account. They can launch coins, pump & dump bags, scam, tribalize, and self-organize—none of it hardcoded. just vibes and emergent behavior. It’s one of the largest financial agent simulations ever run with language models. the art? cooked up with gremplin. the agents? complete sickos. Poof shared that working with AI for the past five months has yielded wild insights about agent behavior at scale, and the ephemeral nature of the project will let them to experiment before considering more permanent implementations. The DX Terminal Mint is live now if you want to go check it out.

Fungi agents

Fungi, one of our portcos, just launched their first agent, and unlike the sea of novelty bots and half-sentient feeds out there, this one has a beautifully simple purpose: make your money work harder while you sleep.

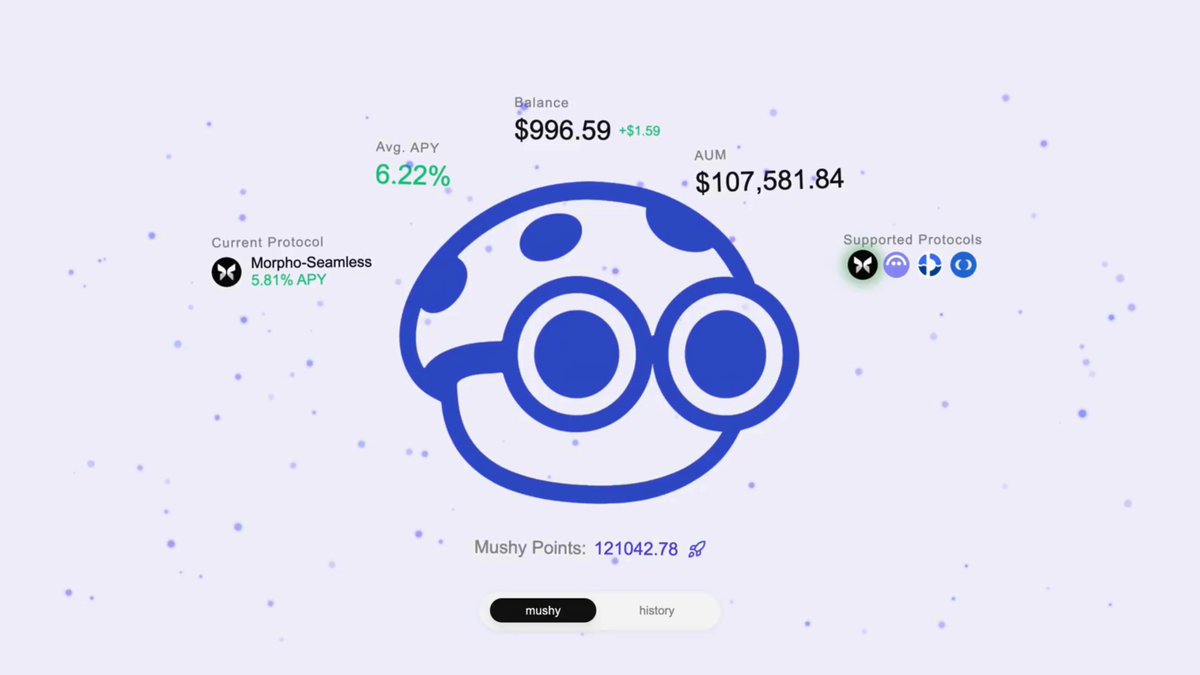

Meet Mushy: a mushroom-themed, yield-maximizing agent for USDC on Base. It quietly hums in the background, scanning the ecosystem every 24 hours across Aave, Morpho, Fluid, and Moonwell to rotate you into the highest yields. No dashboards, no dials. just set it, vibe, and let the spores compound.

But Mushy doesn’t stop at surface APYs. It factors in protocol incentives, slippage, gas, liquidity depth, and risk profiles. It operates through a session-key-based smart account system—meaning you can give it clear, strict instructions, and it won’t color outside the lines. Want it to only touch Aave? Done. $5k tx limit? Easy. Permissions that expire in a week? You’re in control.

The team just crossed 100k in TVL and they’re building for much more. Behind the scenes is a full agent studio, designed to let anyone spin up similar products with minimal overhead and maximal magic. Because let’s be real: most people don’t want to manage ten protocols. They want results.

To try out the beta, create an account, plug in your wallet or use social login, deposit funds, and hit “Start Automation.” then return to your regularly scheduled doomscrolling while Mushy tends the yield forest on your behalf.

Zora: From Micro Markets to Mainstream

Zora has been quietly crushing. In the two months since launching its coin-based model, the protocol has pulled in 2.6M traders, 128k creators, and over $258M in volume. Instead of pairing every post-coin with ETH, they’ve now made $ZORA the default base pair, meaning creator rewards now feed back into the ecosystem. A flywheel of token mechanics, content, and speculative joy.

The zora app is what happens when a social network accidentally becomes a market protocol. Double-tap to buy. No discord raids, no yelling at the dev asking their roadmap. Just pure content capitalism, clean and addictive like a slot machine designed by charles and ray eames.

Jacob describes the internet as "kind of half complete," referencing stewart brand’s duality: information wants to be free… but also expensive. Zora isn’t trying to fix that tension; they’re leaning into it, replacing ad-fueled content traps with public, open markets. The game isn’t clicks...it’s virality powered by actual demand.

In this world, a post isn’t just a post: it’s a coin. Not metaphorically. Literally. Creators get paid because people want to own the content they love, not because they stumbled into an algorithmic engagement minefield. Value emerges from attention, but only when it’s real.

Their new focus: micro markets. Content starts close to zero (as it should), but the rails are built for breakout velocity. The challenge is designing markets that don’t get sniped, but still allow for price discovery without the chaos of every drop becoming a gas war. They’re experimenting with Uniswap v4 under the hood and shipping major upgrades soon.

Onboarding is aggressively smooth. post, get paid, no need to touch the dark forest of crypto UX. And unlike the usual approach of wrapping crypto in vague lifestyle metaphors, zora is refreshingly upfront: this is a social network where every post is a coin. Normies become natives not through hand-holding, but through coins and content.

Download the zora app. available on iOS, android, and the part of your brain that still believes in the internet.

mini apps on apps on apps

Missed the mini app spotlight during farcon? You can catch the full stream here, with 17 demos from top mini app builders. get inspired.

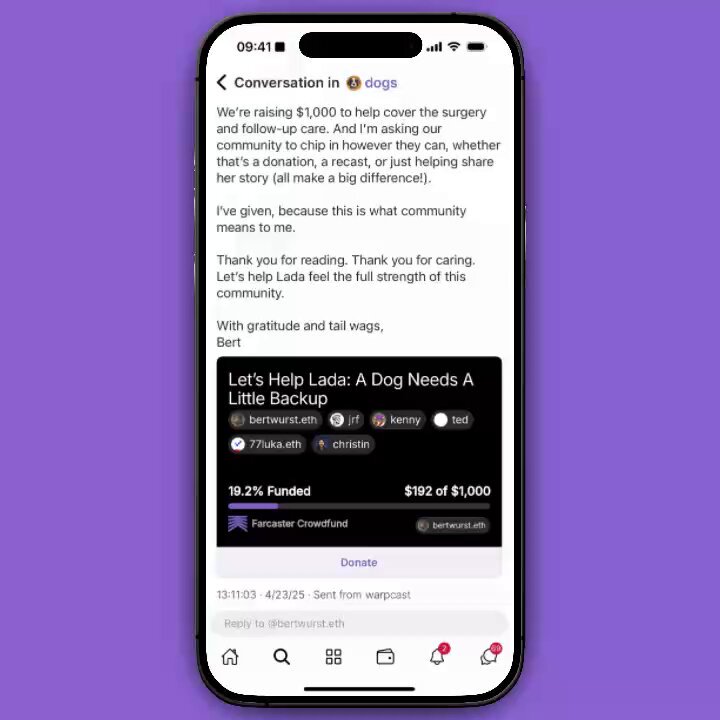

Seed Club built Crowdfund as a practical expression of Network Capital.

It’s a tool for builders to raise funds by activating belief. Social-first capital formation at internet speed. By launching what feels to us like an obvious tool, we’re trying to show (not tell) what crypto makes possible. Crypto is the how, not the why. Fund Good Ideas is an open invitation: if you’ve got conviction, a network, and a reason to build—Crowdfund is for you.

is an open invitation: if you’ve got conviction, a network, and a reason to build—Crowdfund is for you.

Try Crowdfund today on Farcaster and the Web.

Live & online Fridays at 10am PT / 1pm ET.

384

384

$1M

$1M